He was taught that debt was detrimental. Yet it’s the very thing that made him rich.

Most people spend their lives terrified of owing anyone a cent. Payden Squires grew up watching his family struggle, swearing he’d never fall into the same trap. But when he learned how to turn beneficial debt into leverage, everything changed. His living-room startup became a thriving wealth practice serving seven- and eight-figure founders—and his views on money, risk, and freedom flipped upside down.

In this edition, we’ll unpack how a small-town accountant broke free from scarcity thinking, used debt as a tool instead of a trap, and built a business that now runs without him—and how you can apply the same mindset to scale your freedom.

🧠 Remarkable & Relevant Facts 💡

(Did you know…?)

Over half of all U.S. tax returns are prepared by paid professionals.

More than 54% of Americans rely on accountants or tax preparers rather than filing their own taxes—proof that most of the industry focuses on compliance, not strategy. (learn more)

The average small business in America carries $195,000 in debt.

Debt isn’t the enemy—it’s the norm. Most entrepreneurs leverage borrowed capital to grow, not survive. (learn more)

68% of small firms have active debt—and nearly 1 in 10 owe over $1 million.

Smart founders don’t fear debt; they use it. Strategic leverage separates stagnant businesses from scalable ones. (learn more)

The Two-Cent Wake-Up

It started with a performance review.

Payden had outperformed everyone in his department—long hours, flawless numbers, perfect compliance. His reward: a two-percent raise, barely twenty cents an hour. His boss said he should be “grateful.” That moment broke something open. “I realized I could never work for anyone again,” he said. “No matter how hard I worked, I’d always earn what someone else decided I was worth.” That twenty cents became the spark. In 2014, with the support of his wife, he quit his job, cleared the dining table in his small Missouri home, and launched his tax practice. No clients. No roadmap.

Just a belief that profit, not wages, builds freedom.

How to pick the right global payroll mode

Find your fit: Deel’s free guide breaks down 3 global payroll models with key benefits and tradeoffs for HR and finance teams.

From Chaos to Clarity

Paden’s childhood was messy.

A father lost to addiction. A mother studying nights to keep the lights on. Money was always scarce, and fear was constant. That instability became his obsession. “I didn’t want money for luxury,” he said. “I wanted money so I’d never feel powerless again.” At first, that fear drove him to chase income, not impact. He built a practice focused on tax preparation—the same rearview-mirror work that dominates the accounting world. But slowly, through reading, reflection, and the bruises of entrepreneurship, he began to see the pattern: wealth doesn’t come from filling boxes; it comes from forward planning. That shift—from compliance to clarity—turned his small practice into a real business.

He stopped preparing taxes and started designing financial strategies for founders who wanted to keep more of what they earned.

Debt isn’t dangerous. Ignorance about debt is.

The Power of “Good Debt”

Most of us grow up hearing debt is bad. Payden heard it constantly.

In rural Missouri, debt meant danger—repossessions, broken homes, and shame. But when he started working with wealthy entrepreneurs, he noticed something strange: they all had debt—and they weren’t ashamed of it. They used it like a tool. Borrow cheap, invest smart, and earn the spread. It wasn’t reckless—it was strategic. “Debt is leverage,” he told me. “It’s not evil if it earns more than it costs.” He used that principle to scale his own firm, investing in people, systems, and marketing long before he “could afford it.” The returns came back tenfold. His rule: if the debt fuels growth, not consumption, it’s good debt.

And in an inflationary world where currency loses value every year, holding debt at fixed rates can actually protect your wealth.

Small Habits, Big Divide

Here’s what surprised him most: the difference between someone making $100,000 and $1 million a year isn’t talent—it’s tiny habits.

“The gap looks huge from the outside,” Payden said. “But in reality, it’s the compounding of small daily choices.” One more phone call. One more sales pitch. One hour less of distraction. Like interest, consistency compounds. Over a decade, those micro-decisions build a life that looks “lucky.” That realization reshaped how he coached clients. He stopped telling them to think big and started telling them to act small—daily.

You don’t need a ten-year plan. You need a twenty-minute habit

The Exit Mindset

Eleven years later, Paden’s firm runs mostly without him.

He’s now the strategist, not the technician. He helps founders plan their exits—and prepare to sell before they burn out. His mantra: “The best time to plan your exit is day one. The second-best is today.” Whether it’s taxes, debt, or business itself, his message is consistent: clarity wins. Begin with the end in mind. Use leverage wisely. Build something that works without you.

Because freedom isn’t about never owing anyone—it’s about designing systems that repay you forever. That’s a wrap!

Talk soon,

Roman

Struggles? Good.

We help founders transform their stories, values, and experiences into high-trust newsletters with done-for-you ghostwriting and Meta ads.

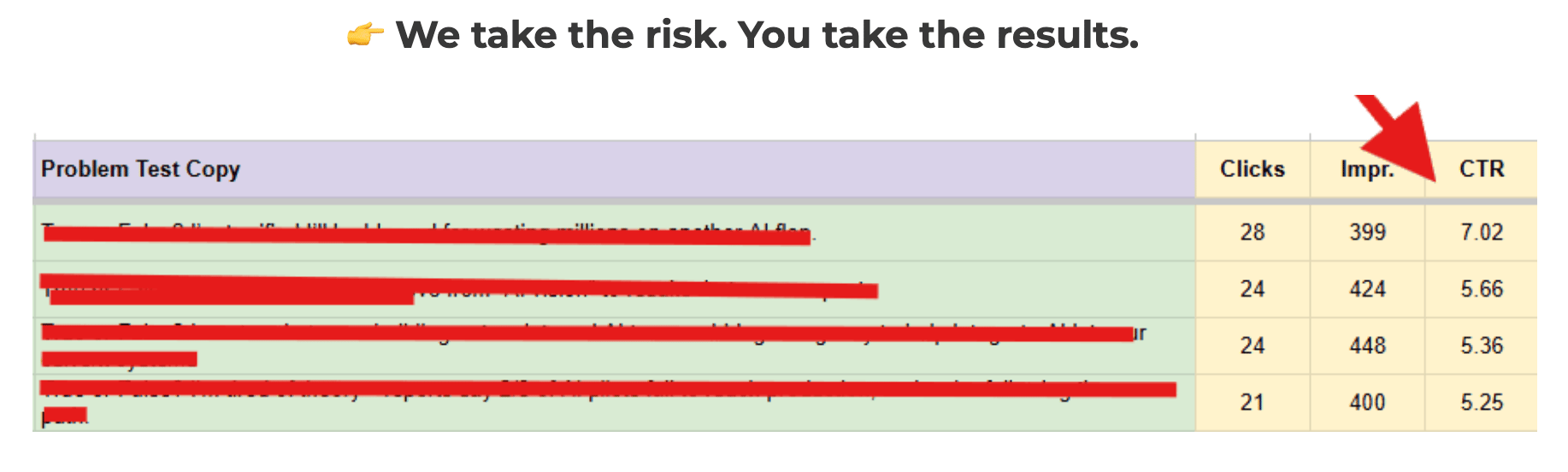

This approach allows rapid list growth and high-ticket sales, attracting 30 to 60 qualified high-ticket appointments per month. Here’s the difference: We deliver results before you pay.

How?

Qualified clients receive a free trial sprint where we test your messaging, problem statements, and positioning.

You’ll see clear data on what resonates, what gets clicked, and whether your campaign has the potential to scale. No guesswork. No empty promises. Just done-for-you as proof.

Want to find out if you qualify? Let’s talk!

👇🏼